If you are running a firm or a company in India, it’s imperative to recognize that operating a business entails adhering to certain regulatory procedures. One such crucial step is registering your business with the state in which you are conducting operations. This process is not just a mere formality; it is a vital component of ensuring legal compliance and accountability. In the case of businesses operating within the Indian state of Karnataka, compliance with the Karnataka Shops and Commercial Establishments Act is a mandatory requirement. In a previous blog post, we provided an overview of Karnataka Shops and Commercial Establishment, 1961. In this particular blog entry, we will delve into the intricacies of the registration process, shedding light on the steps and requirements to navigate this vital aspect of running a business in Karnataka.

Why should you register under the Karnataka Shops and Commercial Establishment Act 1961?

There are many reasons why you should register your business under the Karnataka Shops and Commercial Establishment. Here are a few of them:

- Smooth Business Operations: Failure to register under the Karnataka Shops and Commercial Establishment Act not only invites penalties but it can also lead you to potential legal issues. Such challenges can disrupt your business’s day-to-day activities and even tarnish your brand image in the market.

- Compliance with Laws: Registration under this Act ensures that your business complies with statutory requirements related to working hours, rest periods, and other labor-related regulations. This not only helps you avoid legal issues and penalties but also fosters a harmonious work environment, promoting employee satisfaction and productivity.

- GST Registration: Compliance with state-level laws, like the Shops and Commercial Establishments Act, is often a prerequisite for GST (Goods and Services Tax) registration. GST is a crucial aspect of modern business operations in India. Registering your business under the Shops and Commercial Establishments Act positions you well to fulfill GST requirements, enabling seamless tax compliance and eligibility for input tax credit.

- Current Bank Account Opening in Banks: While the Shops and Establishment registration certificate may not be a mandatory document in banks, it can act as a

proof of registration. It can serve as an essential document that validates your business’s legal status, making it easier to access banking services. - Easy Availability of Loans: Registering your business under statutory laws, including the Shops and Commercial Establishments Act, can improve your eligibility for business loans. Financial institutions often consider legal compliance as a positive factor when assessing loan applications, increasing your chances of securing funding for business expansion or working capital.

Documents required for registration under the Karnataka Shops and Commercial Establishments Act 1961

Before delving into the registration process, it’s essential to understand the documentation requirements thoroughly. Ensuring you have all the necessary documents in order will streamline the registration process and prevent any unnecessary delays or complications. So, let’s begin by discussing the specific documents you’ll need to prepare for a smooth and efficient registration process.

Documents for Sole Proprietorship:

- PAN card

- Address proof

- Rental agreement

- Passport size photographs.

Documents for Partnership Firms:

- PAN cards

- Address Proofs

- Identity proofs

- Rental agreement

- Passport size photographs of all the partners

- Partnership deed

Documents required for a Private Limited Company:

- PAN cards

- Incorporation certificate

- Address and identity proofs

- MOA (Memorandum of Association)

- Rental Agreement

- AOA (Article of Association)

- Passport size photographs of all the directors.

Kindly note, you can use the following documents for various purposes in the registration process

- For identity and address proofs of the owners: Aadhar card, Driving license, Voter Cards etc.

- For the address proof of the establishment: Lease agreement, GST, BBMP Tax receipt, etc

- For the proof of incorporation: Incorporation Certificate, Memorandum of Article

- For the proof of registration: Duly filled Registration Form signed by owner and the authorized signatory

Registration Fees

Registering your business under the Karnataka Shops and Commercial Establishment Act involves a fee that varies based on the number of employees you have. The applicable fees can be found in the table below:

| Registration Fees | |

|---|---|

| Number of Employees | Fees (Rs.) |

| No Employees | 300/- |

| 1 to 9 Employees | 600/- |

| 10 to 19 Employees | 4000/- |

| 20 to 49 Employees | 10000/- |

| 50 to 99 Employees | 20000/- |

| 100 to 250 Employees | 40000/- |

| 251 to 500 Employees | 50000/- |

| 501 to 1000 Employees | 70000/- |

| Above 1000 Employees | 75000/- |

Online Registration Process

Once you are ready with all the requirements, you can start the registration process by visiting the official e-Karmika portal. You can follow the steps mentioned below:

1) Visit https://www.ekarmika.karnataka.gov.in/ekarmika/Static/Home.aspx and click on the “New Registrations” link which is highlighted with green color

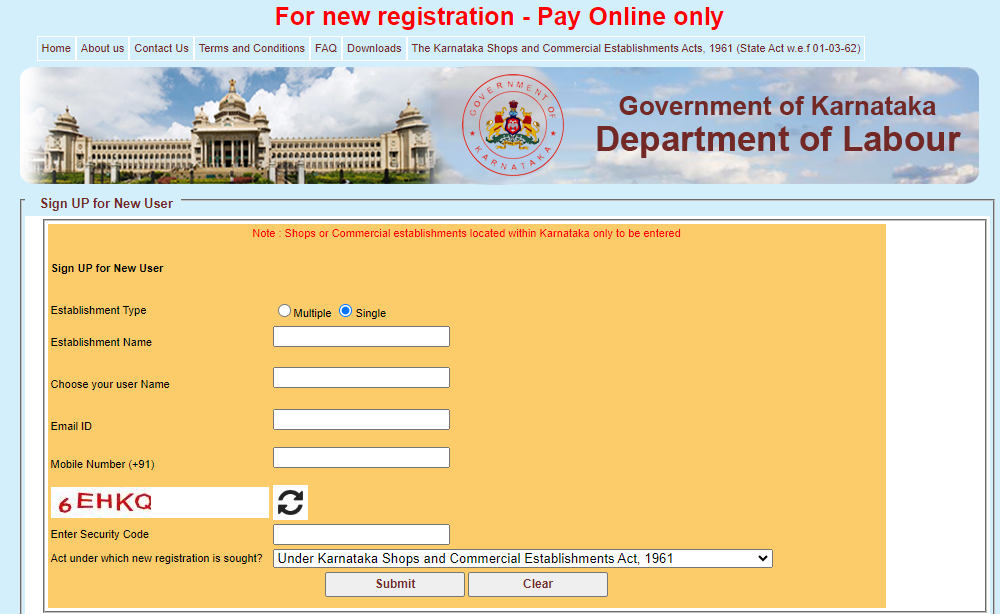

2) After clicking on the button, you will reach the page for new user registration. You need to select the establishment type, the name of your establishment, enter your email ID and mobile number, and write the security code in the text box. The security code is the text appearing inside the white box just below the mobile number field.

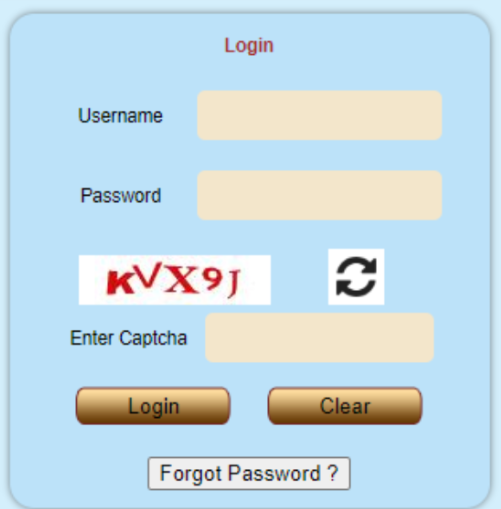

3) After completing the new user registration, you should receive your username and password on your mobile and email. You can go back to the homepage of the portal and use the username and password to login.

4) Once logged in, you need to click on the “Registration (Part A)” tab and start entering all the details of your business.

5) In the next pages, you’ll need to fill in your personal details and upload the document that we discussed in the previous section.

6) Finally, you can make the payment as per the number of employees in your organization. You’ll find multiple payment options including internet banking, debit cards, UPI, etc.

7) After the confirmation of the payment, the portal will generate an acknowledgement number. You can submit the physical copy of the application in the labour office. You should receive your registration certificate once it is verified by a Labour Inspector.

What’s Next?

Obtaining your Karnataka Shops and Commercial Establishment registration certificate should be a straightforward process by following the steps outlined in this post. However, we understand that challenges may arise during the registration process, or you might prefer the expertise of professionals for a quick and efficient registration experience. That’s where we come in. With over two decades of experience specializing in labor compliance, including expertise in Labor Laws and Industrial Laws, we are well-equipped to assist you.

Furthermore, we can provide you with cutting-edge technology products designed to ensure your ongoing compliance, allowing you to focus on your business while we handle the regulatory aspects. Feel free to reach out to us for expert assistance and peace of mind with labour compliance.

Fill the Below Form Now to get Expert Assistance